The Compensation Committee of the Board of Directors has reviewed the Company's policies and practices applicable to employees, including the Company's benefit plans, arrangements and agreements, and does not believe that they are reasonably likely to have a material adverse effect on the Company. The Committee does not believe that the Company's policies and practices encourage officers or employees to take unnecessary or excessive risks or behavior focused on short-term results rather than the creation of long-term value.

Report of the Compensation Committee

We have reviewed and discussed with management the Compensation Discussion and Analysis disclosures to be included in the Company's Proxy Statement for the Annual Meeting of Shareholders to be held in February 20162017 and filed with the SEC pursuant to Section 14(a) of the Securities Exchange Act of 1934. Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the Compensation Discussion and Analysis referred to above be included in the Company's Proxy Statement.

Compensation Committee

Francis V. Mulcahy (Chairman)

A.J. Fanelli

John C. Hosier

Bruce E. Miller

Summary Compensation Table

The following table summarizes the total compensation paid by Prudential Savings Bank (including amounts deferred, if any, to future periods by the officers) for services rendered in all capacities during the fiscal years ended September 30, 2016, 2015 2014 and 20132014 to the principal executive officer, the personsperson who served as principal financial officer during fiscal 2015,2016, the two other executive officers of Prudential Savings Bank during fiscal 20152016 whose total compensation exceeded $100,000 and an executive officer who resigned prior to September 30, 20152016 but would have been included if he was still an executive officer as of such date, collectively referred to as our "named executive officers." The Company has not paid separate cash compensation to our officers.

Name and Principal Position | | Fiscal Year | | | Salary | | | Bonus(1) | | | Stock Awards(2) | | | Option Awards(2) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings(3) | | | All Other Compensation(4) | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Joseph R. Corrato(5) President and Chief Executive Officer | | | 2015 2014 2013 | | | $ | 235,382 213,632 207,409 | | | $ | -- 13,923 12,656 | | | $ | 366,900 -- 29,000 | | | $ | 343,500 -- 42,525 | | | $ | 202,000 144,000 -- | | | $ | 65,471 76,641 77,563 | (6) | | $ | 1,213,253 448,196 369,153 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Jeffrey T. Hanuscin Vice President/Controller | | | 2015 2014 2013 | (7) | | | 120,120 114,583 36,667 | | | | -- 3,000 839 | | | | 61,150 -- 37,674 | | | | 50,380 -- 35,982 | | | | 15,000 4,000 -- | | | | 11,978 100 -- | | | | 258,628 121,683 111,162 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Jack E. Rothkopf(5) Senior Vice President, Chief Financial Officer and Treasurer | | | 2015 2014 2013 | | | | 160,681 151,477 121,876 | | | | -- 4,986 4,389 | | | | 183,450 -- 15,950 | | | | 229,000 -- 19,688 | | | | 46,000 31,000 2,000 | | | | 16,491 9,541 5,884 | | | | 635,622 197,004 169,786 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Salvatore Fratanduono(8) Senior Vice President and Chief Lending Officer | | | 2015 2014 2013 | | | | 127,462 159,271 144,089 | | | | -- 8,065 6,893 | | | | 183,450 -- 15,950 | (9) | | | 229,000 -- 19,688 | (9) | | | 134,000 99,000 -- | | | | 40,051 10,563 5,951 | (10) | | | 713,963 276,899 192,571 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Thomas A. Vento(5) Chairman | | | 2015 2014 2013 | | | | 315,842 343,105 333,111 | | | | -- 22,361 20,326 | | | | 733,800 -- 45,711 | | | | 503,800 -- 63,999 | | | | 286,000 1,000 -- | | | | 69,993 80,459 83,611 | (6) | | | 1,909,435 446,925 546,758 | |

Name and Principal Position | | Fiscal Year | | | Salary | | | Bonus(1) | | | Stock Awards(2) | | | Option Awards(2) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings(3) | | | All Other Compensation(4) | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Dennis Pollack(5) President and Chief Executive Officer | | 2016 | | | $ | 108,462 | | | $ | 20,000 | | | $ | 36,050 | | | $ | 21,300 | | | $ | -- | | | $ | 4,125 | (4)(6) | | $ | 189,937 | |

Joseph R. Corrato(5) President and Chief Executive Officer | | | 2016 2015 2014 | | | | 170,184 235,382 213,632 | | | | -- -- 13,923 | | | | -- 366,900 -- | | | | -- 343,500 -- | | | | 212,000 202,000 144,000 | | | | 75,057 65,471 76,641 | (4)(6) | | | 455,241 1,213,253 448,196 | |

Anthony V. Migliorino(7) Executive Vice President and Chief Operating Officer | | | 2016 2015 | | | | 172,368 33,750 | | | | 20,000 -- | | | | 108,150 -- | | | | 31,950 -- | | | | -- -- | | | | 690 750 | (6) | | | 333,158 24,500 | |

Jeffrey T. Hanuscin First Vice President/Controller | | | 2016 2015 2014 | | | | 120,495 120,120 114,583 | | | | 10,000 -- 3,000 | | | | -- 61,150 -- | | | | -- 50,380 -- | | | | 9,000 15,000 4,000 | | | | 16,690 11,978 100 | (4) | | | 156,185 258,628 121,683 | |

Jack E. Rothkopf Senior Vice President, Chief Financial Officer and Treasurer | | | 2016 2015 2014 | | | | 156,912 160,681 151,477 | | | | 5,000 -- 4,986 | | | | -- 183,450 -- | | | | -- 229,000 -- | | | | 39,000 46,000 31,000 | | | | 28,894 16,491 9,541 | (4) | | | 229,806 635,622 197,004 | |

___________________________________________

| (1) | Represents discretionary bonuses earned in each fiscal year reflected but which were paid in the following fiscal year. No bonusesBonuses were awarded to the named executive officers with respect to fiscal 2015. Under the Prudential Savings bonus program, each named executive officer was eligible to receive a fixed proportionate allocation of the bonus pool for employeesdiscretionarily determined based on salary and length of service.Company performance as well as individual performance. |

| (2) | Reflects the grant date fair value in accordance with FASB ASC Topic 718 for awards of restricted stock and stock options that were granted during the fiscal 20132015 and fiscal 2015.2016. The valuations of the restricted stock awards granted in fiscal 20132015 and fiscal 20152016 are based on grant date fair values of $7.25$12.23 and $12.23,$14.42, respectively, per share for grants made in fiscal 20132015 and fiscal 2015.2016. The assumptions used in valuing the stock option awards granted in fiscal 20132015 and fiscal 20152016 are set forth in Note 1213 to the Consolidated Financial Statements included in the Annual Report on Form 10-K for the year ended September 30, 2015.2016. |

| (3) | Represents the sum of the actuarial change in pension value in plan years 2012, 2013, 2014 and 20142015 for Messrs. Vento, Corrato, Hanuscin Rothkopf and FratanduonoRothkopf pursuant to their participation in the Defined Benefit Plan, a multiple employer tax-qualified defined benefit plan. The amounts were substantially larger in fiscal 2014 due toreflect the effect of the adoption of the new mortality table (RP-2014). In fiscal 2013, Messrs. Corrato, FratanduonoPollack and Vento experienced declinesMigliorino are not participating in the present value of accrued benefits of $72,000, $38,000 and $162,000, respectively.Defined Benefit Plan. |

(Footnotes continued on the following page)

___________________

| (4) | Includes the fair market value on December 31, 20142015 of the 1,922, 943, 1,293, 1,4042,349, 1,098 and 2,1501,572 shares allocated for plan year 2015 to the ESOP accounts of Messrs. Corrato, Hanuscin Rothkopf, Fratanduono and Vento,Rothkopf, respectively, based on a value of $12.50$15.20 per share on December 31, 2014.2015. As of such date, Messrs. Pollack and Migliorino were not participants in the ESOP. |

(Footnotes continued on the following page)

____________________________

| (5) | Effective Julyas of May 1, 2015,2016, Mr. CorratoPollack was appointed President of the Company and Prudential Savings and subsequently on October 1, 2015, he was appointed as Chief Executive Officer of the Company and Prudential Savings. The appointment of Mr. Corrato reflected the implementation of the Company's succession plan in connection with the transition of Mr. Vento, the then Chairman, President and Chief Executive Officer, to retirement. Mr. Vento served as Chairman, President and Chief Executive Officer of the Company and Prudential Savings Bank until July 1, 2015, at which time he retired from his positionand Mr. Corrato resigned as President. He subsequently retired from his position asPresident and Chief Executive Officer on September 30, 2015, remaining as the Chairman of the Board of the boards of directors of both the Company and Prudential Savings Bank until December 2015, when he fully retired from the boards of both the Company and the Bank. In connection withentities. Mr. Corrato's appointment as President, Mr. RothkopfCorrato was appointed, effective as the Company's and Prudential Savings' Chief Financial Officer, effective Julyof May 1, 2015.2016, as a director emeritus. Thus, Mr. Pollack's salary data for fiscal 2016 only reflects five months of salary. |

| (6) | Includes, for each ofwith respect to Messrs. VentoPollack and CorratoMigliorino an aggregate of $7,050 paidautomobile allowance in fiscal 2015 through February 2015 as board meeting fees, reimbursement of2016; with respect to Mr. Vento's Philadelphia city wage taxes andCorrato, includes the value of the use of automobiles by Messrs. Vento and Corratoan automobile as well as the value of $13,800 and $15,213, respectively,the vehicle when transferred to him as part of his separation agreement (a total of $23,851) and the provision of health insurance premiums for Messrs. Vento and Corrato in the amount of $10,303 and $20,161, respectively. In February 2015, the Board determined to cease paying directors fees to directors who also serve as salaried full-time officers. The value of the use of automobiles is based on depreciation, as well as insurance, fuel and maintenance expense.($13,501). |

| (7) | Mr. HanuscinMigliorino joined Prudential SavingsBank in May 2013. |

(8) | Mr. Fratanduono resigned, effective as of July 1, 2015; he served as a consultant to Prudential Savings from July 1, 2015 until NovemberJune 2015. |

(9) | As a result of Mr. Fratanduono's resignation, the restricted stock and stock options awarded him in Accordingly, his salary amount for fiscal 2015 were forfeited. |

(10) | Includes consulting fees totaling $22,500 paid to Mr. Fratanduono for the periodonly reflects three and a half months of July 1, 2015 through September 30, 2015.salary. |

Equity Compensation Plans

Grants of Plan-Based Awards for the Year Ended September 20, 2015. 30, 2016. The table below sets forth information regarding grants of awards pursuant to plans our executive officers named in the Summary Compensation Table during the fiscal year ended September 30, 2015.2016.

| Name | | Grant Date | | All Other Stock Awards: Number of Shares of Stock or Units(1) | | | All Other Option Awards: Number of Securities Underlying Options(2) | | | Exercise or Base Price of Option Awards(3) | | | Grant Date Fair Value of Stock and Option Awards(4) | |

| | | | | | | | | | | | | | | |

| Joseph R. Corrato | | 2/18/2015 | | | 30,000 | | | | -- | | | $ | -- | | | $ | 366,900 | |

| | 2/18/2015 | | | -- | | | | 75,000 | | | | 12.23 | | | | 343,500 | |

| | | | | | | | | | | | | | | | | | | |

| Jeffrey T. Hanuscin | | 2/18/2015 | | | 5,000 | | | | -- | | | | -- | | | | 61,150 | |

| | 2/18/2015 | | | -- | | | | 11,000 | | | | 12.23 | | | | 50,380 | |

| | | | | | | | | | | | | | | | | | | |

| Jack E. Rothkopf | | 2/18/2015 | | | 15,000 | | | | -- | | | | -- | | | | 183,450 | |

| | 2/18/2015 | | | -- | | | | 50,000 | | | | 12.23 | | | | 229,000 | |

| | | | | | | | | | | | | | | | | | | |

Salvatore Fratanduono(5) | | 2/18/2015 | | | 15,000 | | | | -- | | | | -- | | | | 183,450 | |

| | 2/18/2015 | | | -- | | | | 50,000 | | | | 12.23 | | | | 229,000 | |

| | | | | | | | | | | | | | | | | | | |

| Thomas A. Vento | | 2/18/2015 | | | 60,000 | | | | -- | | | | -- | | | | 733,800 | |

| | 2/18/2015 | | | -- | | | | 110,000 | | | | 12.23 | | | | 503,800 | |

| Name | | Grant Date | | All Other Stock Awards: Number of Shares of Stock or Units(1) | | | All Other Option Awards: Number of Securities Underlying Options(2) | | | Exercise or Base Price of Option Awards(3) | | | Grant Date Fair Value of Stock and Option Awards(4) | |

| | | | | | | | | | | | | | | |

| Dennis Pollack | | 8/17/2016 | | | 2,500 | | | | -- | | | $ | -- | | | $ | 36,050 | |

| | | 8/17/2016 | | | -- | | | | 10,000 | | | | 14.42 | | | | 21,300 | |

| | | | | | | | | | | | | | | | | | | |

| Anthony V. Migliorino | | 8/17/2016 | | | 7,500 | | | | -- | | | | -- | | | | 108,150 | |

| | | 8/17/2016 | | | -- | | | | 15,000 | | | | 14.42 | | | | 31,950 | |

| | | | | | | | | | | | | | | | | | | |

___________________

| (1) | The restricted stock awards granted February 18, 2015August 17, 2016 vests at the rate of 20% per year, starting February 18, 2016.August 17, 2017. |

| (2) | The stock options granted vestvests at the rate of 20% per year, starting February 18, 2016.August 17, 2017. |

| (3) | Based upon the fair market value of a share of Company common stock on the date of grant. |

| (4) | The fair value of the restricted stock awards and/or stock options granted is computed in accordance with FASB ASC Topic 718. |

(5) | Mr. Fratanduono resigned, effective July 1, 2015. In accordance with the terms of the 2014 SIP pursuant to which the grants were made, all of the restricted stock and stock options granted to him on February 18, 2015 were forfeited. |

Outstanding Equity Awards at Fiscal Year-End.The table below sets forth outstanding equity awards at September 30, 20152016 to our executive officers named in the Summary Compensation Table above, which grants were made in fiscal years 2009, fiscal 2013, 2015 and fiscal 2015.2016. With respect to restricted stock awards and stock options granted prior to the completion of the second stepsecond-step conversion on October 9, 2013, the number of shares subject to the stock options and the stock awards as well as the exercise price of the stock options have been adjusted to reflect the second stepsecond-step conversion.

| | | | | | | | | | | | | Stock Awards(1) | | | | | | | | | | | | | | | Stock Awards(1) | |

| | | Option Awards(1) | | | | | Market Value | | | | | | | | | | | | | | | | | | Market Value | |

| | | Number of Securities | | | | | | | Number of | | | of Shares or | | | Option Awards(1) | | | Number of Shares | | | Of Shares or | |

| | | Underlying Unexercised | | | | | Option | | Shares or Units | | | Units of Stock | | | Number of Securities Underlying | | | | | | Option | | | Or Units of Stock | | | Units of Stock | |

| | | Options | | | Exercise | | Expiration | | of Stock That | | | That Have | | | Unexercised Options | | | Exercise | | | Expiration | | | That Have Not | | | That Have Not | |

| Name | | Exercisable | | | Unexercisable | | | | Price | | Date | | Have Not Vested | | | | Not Vested(2) | | | Exercisable | | | Unexercisable | | | Price | | | Date | | | Vested | | | Vested(2) | |

| Joseph R. Corrato | | | 53,382 5,098 -- | (3) (4) | | | -- 7,648 75,000 | (5) | | $ | 11.84 7.68 12.23 | | 1/5/2019 1/5/2023 2/18/2025 | | | 2,266 30,000 | (4) (5) | | $ | 32,653 432,300 | | |

Dennis Pollack | | | | 6,000 | (3) | | | 24,000 | | | $ | 12.23 | | | 2/18/2025 | | | | 8,000 | (3) | | $ | 115,840 | |

| | | | | -- | | | | 10,000 | (4) | | | 14.42 | | | | 8/172026 | | | | 2,500 | (4) | | | 36,200 | |

| Joseph R. Corrato. | | | | 53,382 | (5) | | | -- | | | | 11.84 | | | 1/5/2019 | | | | 1,511 | (6) | | | 21,789 | |

| | | | | 7,647 | (6) | | | 5,099 | | | | 7.68 | | | 1/5/2023 | | | | 24,000 | (3) | | | 346,080 | |

| | | | | 15,000 | (3) | | | 60,000 | | | | 12.23 | | | 2/18/2025 | | | | | | | | | |

| Anthony V. Migliorino | | | | -- | | | | 15,000 | (4) | | | 14.42 | | | 8/17/2026 | | | | 7,500 | (4) | | | 108,150 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jack E. Rothkopf | | | | 18,683 | (5) | | | -- | | | | 11.84 | | | 1/5/2019 | | | | 832 | (4) | | | 11,997 | |

| | | | | 3,540 | (6) | | | 2,361 | | | | 7.68 | | | 1/5/2023 | | | | 12,000 | (5) | | | 173,040 | |

| | | | | | | | | | | | | | | | | | | | | | | | | 10,000 | (3) | | | 40,000 | | | | 12.23 | | | 2/18/2025 | | | | | | | | | |

| Jeffrey T. Hanuscin | | | 4,068 -- | (6) | | | 6,103 11,000 | (4)(5) | | | 9.66 12.23 | | 6/19/2023 2/18/2025 | | | 2,210 5,000 | (6) (5) | | | 31,846 72,050 | | | | 6,102 | (7) | | | 4,069 | | | | 10.24 | | | 6/19/2023 | | | | 1,474 | (7) | | | 21,255 | |

| | | | | | | | | | | | | | | | | | | | | | | | | 2,200 | (3)(6) | | | 8,800 | | | | 12.23 | | | 2/18/2025 | | | | 4,000 | (3) | | | 57,680 | |

| Jack E. Rothkopf | | | 18,683 2,360 -- | (3) (4) | | | -- 3,541 50,000 | (5) | | | 11.84 7.68 12.23 | | 1/5/2019 1/5/2023 2/18/2025 | | | 1,247 15,000 | (4) (5) | | | 17,969 216,150 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Salvatore Fratanduono(6) | | | 21,353 2,360 | (3) (4) | | | -- -- | | | | 11.84 7.68 | | 1/1/2016(7) 1/1/2016(7) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Thomas A. Vento | | | 106,764 7,672 -- | (3) (4) | | | -- 11,511 110,000 | | | | 11.84 7.68 12.23 | | 1/5/2019 1/5/2023 2/18/2025 | | | 3,573 60,000 | (4) (5) | | | 51,487 864,600 | | |

___________________

| (1) | Each of the option awards and stock awards outstanding as of October 9, 2013 was converted into an option award or stock award to purchase a number of shares of common stock of Prudential Bancorp equal to the product of the number of shares of common stock multiplied by the exchange ratio of 0.9442, rounded down to the nearest whole share. Each option after the exchange has an adjusted exercise price equal to the quotient obtained by dividing the option exercise price by the exchange ratio of 0.9442, rounded up to the nearest whole cent. |

| (2) | Calculated by multiplying the closing market price per share of our common stock on September 30, 2015,2016, which was $14.41,$14.48, by the applicable number of shares of common stock underlying the named executive officer's unvested stock awards. |

| (3) | Granted pursuant to our 2014 Stock Incentive Plan and vest at a rate of 20% per year commencing on February 18, 2016. |

| (4) | Granted pursuant to our 2008 SOP orStock Option Plan, our 2014 Stock Incentive Plan and our 2008 RRP,Recognition and Retention Plan, as applicable, and vest at a rate of 20% per year commencing on August 17, 2017. |

| (5) | Granted pursuant to our 2008 Stock Option Plan and our 2008 Recognition and Retention Plan, as applicable, and vested at a rate of 20% per year commencing on January 5, 2010, becoming fully vested on January 5, 2014. |

(4)(6) | Granted pursuant to our 2008 SOP orStock Option Plan and 2008 RRP,Recognition and Retention Plan, as applicable, and vest at a rate of 20% per year commencing on January 5, 2014. |

(5)(7) | Granted pursuant to our 2014 SIP2008 Stock Option Plan and our 2008 Recognition and Retention Plan, as applicable, and vest at a rate of 20% per year commencing on February 18, 2016.June 19, 2014. |

(6) | Mr. Fratanduono resigned effective July 1, 2015; all unvested restricted stock and stock options outstanding as of such date granted to him were forfeited. |

(7) | Mr. Fratanduono had six months from the effective date of his resignation to exercise the vested options. |

25

Option Exercises and Stock Vested.The following table sets forth certain information with respect to restricted stock awards which vested for the named executive officers during the fiscal year ended September 30, 2015.2016. No stock options were exercised by any of the named executive officers during the fiscal year.

| | | Stock Awards | |

| Name | | Number of Shares Acquired On Vesting(1) | | | Value Realized On Vesting(2) | |

| | | | | | | |

| Joseph R. Corrato | | | 755 | | | $ | 9,264 | |

| | | | | | | | | |

| Jeffrey T. Hanuscin | | | 736 | | | | 10,620 | |

| | | | | | | | | |

| Jack E. Rothkopf | | | 415 | | | | 5,092 | |

| | | | | | | | | |

| Salvatore Fratanduono | | | 415 | | | | 5,092 | |

| | | | | | | | | |

| Thomas A. Vento | | | 1,190 | | | | 14,601 | |

| | | | Stock Awards | |

| | Name | | Number of Shares Acquired On Vesting(1) | | | Value Realized On Vesting(2) | |

| | | | | | | | |

| | Dennis Pollack | | | 2,000 | | | $ | 30,600 | |

| | | | | | | | | | |

| | Joseph R. Corrato | | | 755 | | | | 11,265 | |

| | | | | 6,000 | | | | 91,800 | |

| | | | | | | | | | |

| | Jack E. Rothkopf | | | 415 | | | | 6,192 | |

| | | | | 3,000 | | | | 45,900 | |

| | | | | | | | | | |

| | Jeffrey T. Hanuscin | | | 736 | | | | 10,981 | |

| | | | | 1,000 | | | | 15,300 | |

_________________

| (1) | Does not reflect the sale or withholding of shares to satisfy income tax withholding obligations. |

| (2) | Based upon the fair market value of a share of Company common stock on the date of exercise or vesting. Value is calculated by multiplying the number of shares of Company common stock that vested by the fair market value on the date of vesting. |

Employment and Change-in-ControlChange in Control Agreements

Prudential Savings hasBank and Prudential Bancorp entered into employment with Messrs. Corratoan amended and Rothkopf and a change-in-control severancerestated employment agreement with Mr. Hanuscin.Pollack in December 2016, amending and restating his earlier employment agreement entered into in May 2016 upon his appointment as President and Chief Financial Officer. In addition, Prudential Bank has previously entered into change in control severance agreements with Messrs. Hanuscin and Migliorino. In December 2016, Prudential Bank and Prudential Bancorp entered into an employment agreement with Mr. Migliorino which superseded his change in control severance agreement. Mr. Rothkopf had an employment agreement with the Bank which expired December 31, 2016. Prior to such date, the Bank had entered into a change in control agreement with Mr. Rothkopf which became effective as of January 1, 2017. For additional information, see "–Compensation and Discussion Analysis – Additional Components of Executive Compensation – Employment Agreements" and "–Change in Control Agreements." In addition, the BankThe change in November 2015 entered into change-in-controlcontrol severance agreements with Messrs. Migliorino and Smith. Such agreements are structured in the same manner asexcept with regard to the agreement with Mr. Hanuscin with the difference being that the agreement with Mr. Migliorino provides for aseverance payment multiplier of two rather than one and athe benefit coverage period of two years rather than one.

period.

26

Potential Payments uponUpon Termination of Employment or a Change in Control

The following tables present potential payments to the named executive officers (other than Mr. Corrato) if their employment was terminated under various situations. However, the presentation is based on the employment arrangements that were in effect as of September 30, 2016. Subsequent to such date, Prudential Bank and Prudential Bancorp entered into an amended and restated employment agreement with Mr. Pollack and a new employment agreement with Mr. Migliorino. In addition, Mr. Rothkopf was under an employment agreement as of September 30, 2016 which as of January 1, 2017 was superseded by a change in control agreement, while Mr. Migliorino was under change in control agreement as of September 30, 2016 was superseded by the employment agreement referenced above.

The following table describes the potential payments to Joseph R. Corrato,Dennis Pollack, President and Chief Executive Officer, upon an assumed termination of employment or a change in control as of September 30, 2015.2016.

| Payments and Benefits | | Voluntary Termination | | | Termination for Cause | | | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | | | Change in Control With Termination of Employment | | | | | | Retirement | |

| | | | | | | | | | | | | | | | | | | |

| Severance payments and benefits: (a) | | | | | | | | | | | | | | | | | | |

| Cash severance (b) | | $ | -- | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | -- | |

| Medical and other insurance benefits (c) | | | -- | | | | -- | | | | 1,853 | | | | 3,706 | | | | -- | | | | -- | |

| Automobile expenses (d) | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| §280G cut-back (e) | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity awards: (f) | | | | | | | | | | | | | | | | | | | | | | | | |

| Unvested stock options (g) | | | -- | | | | -- | | | | -- | | | | 54,600 | | | | 54,600 | | | | -- | |

| Unvested restricted stock awards (h) | | | -- | | | | -- | | | | -- | | | | 152,040 | | | | 152,040 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total payments and benefits (i) | | $ | -- | | | $ | -- | | | $ | 1,853 | | | $ | 210,346 | | | $ | 206,640 | | | $ | -- | |

| Payments and Benefits | | Voluntary Termination | | | Termination for Cause | | | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | | | Change in Control With Termination of Employment | | | | | | Retirement | |

| | | | | | | | | | | | | | | | | | | |

| Severance payments and benefits: (a) | | | | | | | | | | | | | | | | | | |

| Cash severance (b) | | $ | -- | | | $ | -- | | | $ | 416,210 | | | $ | 624,315 | | | $ | -- | | | $ | -- | |

| Medical and other insurance benefits (c) | | | -- | | | | -- | | | | 61,403 | | | | 92,105 | | | | -- | | | | -- | |

| Automobile expenses (d) | | | -- | | | | -- | | | | 10,804 | | | | 16,206 | | | | -- | | | | -- | |

| §280G cut-back (e) | | | -- | | | | -- | | | | -- | | | | (187,943 | ) | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity awards: (f) | | | | | | | | | | | | | | | | | | | | | | | | |

| Unvested stock options (g) | | | -- | | | | -- | | | | -- | | | | 214,971 | | | | 214,971 | | | | -- | |

| Unvested restricted stock awards (h) | | | -- | | | | -- | | | | -- | | | | 464,963 | | | | 464,963 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total payments and benefits (i) | | $ | -- | | | $ | -- | | | $ | 488,417 | | | $ | 1,224,617 | | | $ | 679,924 | | | $ | -- | |

The following table describes the potential payments to Anthony V. Migliorino, Executive Vice President and Chief Operating Officer, upon an assumed termination of employment or a change in control as of September 30, 2016.

| Payments and Benefits | | Voluntary Termination | | | Termination for Cause | | | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | | | Change in Control With Termination of Employment | | | | | | Retirement | |

| | | | | | | | | | | | | | | | | | | |

| Severance payments and benefits: (a) | | | | | | | | | | | | | | | | | | |

| Cash severance (b) | | $ | -- | | | $ | -- | | | $ | -- | | | $ | 315,478 | | | $ | -- | | | $ | -- | |

| Medical and other insurance benefits (c) | | | -- | | | | -- | | | | -- | | | | 13,992 | | | | -- | | | | -- | |

| Automobile expenses (d) | | | -- | | | | -- | | | | -- | | | | 2,760 | | | | -- | | | | -- | |

| §280G cut-back (e) | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity awards: (f) | | | | | | | | | | | | | | | | | | | | | | | | |

| Unvested stock options (g) | | | -- | | | | -- | | | | -- | | | | 900 | | | | 900 | | | | -- | |

| Unvested restricted stock awards (h) | | | -- | | | | -- | | | | -- | | | | 108,600 | | | | 108,600 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total payments and benefits (i) | | $ | -- | | | $ | -- | | | $ | -- | | | $ | 441,730 | | | $ | 109,500 | | | $ | -- | |

(Footnotes following the table on page 25)

The following table describes the potential payments to Jack E. Rothkopf, Senior Vice President, Chief Financial Officer and Treasurer, upon an assumed termination of employment or a change in control as of September 30, 2015.2016.

| Payments and Benefits | | Voluntary Termination | | | Termination for Cause | | | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | | | Change in Control With Termination of Employment | | | | | | Retirement | |

| | | | | | | | | | | | | | | | | | | |

| Severance payments and benefits: (a) | | | | | | | | | | | | | | | | | | |

| Cash severance (b) | | $ | -- | | | $ | -- | | | $ | 272,158 | | | $ | 272,158 | | | $ | -- | | | $ | -- | |

| Medical and other insurance benefits (c) | | | -- | | | | -- | | | | 886 | | | | 886 | | | | -- | | | | -- | |

| Automobile expenses (d) | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| §280G cut-back (e) | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity awards: (f) | | | | | | | | | | | | | | | | | | | | | | | | |

| Unvested stock options (g) | | | -- | | | | -- | | | | -- | | | | 106,055 | | | | 106,055 | | | | -- | |

| Unvested restricted stock awards (h) | | | -- | | | | -- | | | | -- | | | | 185,807 | | | | 185,807 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total payments and benefits (i) | | $ | -- | | | $ | -- | | | $ | 273,044 | | | $ | 564,906 | | | $ | 291,862 | | | $ | -- | |

| Payments and Benefits | | Voluntary Termination | | | Termination for Cause | | | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | | | Change in Control With Termination of Employment | | | | | | Retirement | |

| | | | | | | | | | | | | | | | | | | |

| Severance payments and benefits: (a) | | | | | | | | | | | | | | | | | | |

| Cash severance (b) | | $ | -- | | | $ | -- | | | $ | 252,581 | | | $ | 252,581 | | | $ | -- | | | $ | -- | |

| Medical and other insurance benefits (c) | | | -- | | | | -- | | | | 1,533 | | | | 1,533 | | | | -- | | | | -- | |

| Automobile expenses (d) | | | -- | | | | -- | | | | -- | | | | | | | | -- | | | | -- | |

| §280G cut-back (e) | | | -- | | | | -- | | | | -- | | | | | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity awards: (f) | | | | | | | | | | | | | | | | | | | | | | | | |

| Unvested stock options (g) | | | -- | | | | -- | | | | -- | | | | 132,831 | | | | 132,831 | | | | -- | |

| Unvested restricted stock awards (h) | | | -- | | | | -- | | | | -- | | | | 234,119 | | | | 234,119 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total payments and benefits (i) | | $ | -- | | | $ | -- | | | $_ 254,114 | | | $ | 621,064 | | | $ | 366,950 | | | $ | -- | |

(footnotes following the table on page 28)

The following table describes the potential payments to Jeffrey T. Hanuscin, First Vice President and Controller, upon an assumed termination of employment or a change in control as of September 30, 2015.2016.

Payments and Benefits | | Voluntary Termination | | | Termination for Cause | | | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | | | Change in Control With Termination of Employment | | | Death or Disability (j) | | | Retirement | | | Voluntary Termination | | | Termination for Cause | | | Involuntary Termination Without Cause or Termination by the Executive for Good Reason Absent a Change in Control | | | Change in Control With Termination of Employment | | | Death or Disability (j) | | | Retirement | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Severance payments and benefits: (a) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash severance (b) | | $ | -- | | | $ | -- | | | $ | -- | | | $ | 108,555 | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | 121,297 | | | $ | -- | | | $ | -- | |

| Medical and other insurance benefits (c) | | | -- | | | | -- | | | | -- | | | | 10,536 | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | 7,864 | | | | -- | | | | -- | |

| Automobile expenses (d) | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| §280G tax cut back (e) | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity awards: (f) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unvested stock options (g) | | | -- | | | | -- | | | | -- | | | | 49,430 | | | | 49,430 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 37,053 | | | | 37,053 | | | | -- | |

| Unvested restricted stock awards (h) | | | -- | | | | -- | | | | -- | | | | 103,896 | | | | 103,896 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 79,264 | | | | 79,264 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total payments and benefits (i) | | $ | -- | | | $ | -- | | | $ | -- | | | $ | 272,417 | | | $ | 153,326 | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | 245,478 | | | $ | 116,317 | | | $ | -- | |

__________________________

| (a) | These severance payments and benefits are payable if the employment of Mr. CorratoPollack or Mr. Rothkopf is terminated prior to a change in control either (i) by the Bank for any reason other than cause, disability, retirement or death or (ii) by Mr. CorratoPollack or Mr. Rothkopf if the Bank takes certain adverse actions (a "good reason" termination). The severance payments and benefits are also payable if an executive's employment is terminated concurrently with or following a change in control if the termination of employment occurs during the term of Mr. Corrato'sPollack's or Mr. Rothkopf's employment agreement (the term of Mr. Rothkopf's agreement expired as of December 31, 2016) or during the term of Mr. Migliorino's or Hanuscin's severance agreement. Under Mr. Rothkopf's new change in control agreement, he is entitled to severance payments and benefits only in the event of his termination concurrently with or following a change in control. In addition, under Mr. Pollack's amended and restated employment agreement, the severance benefits have been enhanced and under Mr. Migliorino's new employment agreement, he is entitled to severance in an involuntary separation outside a change in control and to an enhanced level of severance. |

(Footnotes continued on the following page)

__________________________

| (b) | If the employment of Mr. CorratoPollack or Mr. Rothkopf is terminated prior to a change in control, represents a lump sum payment equal to one time the average of the base salary and cash bonus received by Mr. Pollack (excluding any deferred amounts) during the five calendar years preceding the year in which the date of termination occurs and two times such amount for Mr. Rothkopf. In the change in control column, represents a lump sum payment equal to two times for Messrs. Pollack, Migliorino and Rothkopf and one time for Mr. Hanuscin the average of the executive's base salary and cash bonus received by the executive (excluding any deferred amounts) during the five calendar years preceding the year in which the date of termination occurs. In the changeSince Mr. Pollack did not have any cash compensation as an employee in control column, represents a lump sum payment equal to three times for Mr. Corrato (two times for Mr. Rothkopf and one time for Mr. Hanuscin) the averagecalendar 2015, he would not have received any cash severance payments had his employment been terminated as of the executive's base salary and cash bonus received by the executive (excluding any deferred amounts) during the five calendar years preceding the year in which the date of termination occurs.September 30, 2016. |

| (c) | If the employment of Mr. CorratoPollack or Mr. Rothkopf is terminated prior to a change in control, represents the estimated present value cost of providing continued medical, dental, vision, life and accidental death and disability coverage to Messrs. CorratoPollack and Rothkopf for an assumed additional 12 months and 24 months, respectively, at no cost to the executives. In the change in control column, represents the estimated present value cost of providing continued medical, dental, vision, life and accidental death and disability coverage for 3624 months for Mr. Corrato (24 months for Mr.Messrs. Pollack, Migliorino and Rothkopf and 12(12 months for Mr. Hanuscin) at no cost to the executives. The estimated costs assume the current insurance premiums with no increase in the annual premium costs. The amounts have not been discounted to present value. |

| (d) | Represents a lump sum cash payment equal to the estimated costs of paying automobile related expenses for Mr. CorratoMigliorino for an assumed 24 months (36 months if his employment is terminated concurrently with or following a change in control), based on the amounts paid in calendar 2014.paid. |

| (e) | If the parachute amounts associated with the payments and benefits to Messrs. Corrato,Pollack, Migliorino, Rothkopf and Hanuscin in the change in control column equal or exceed three times the executive's average taxable income for the five calendar years immediately preceding the year in which the change in control occurs, such payments and benefits in the event of a change of control will be reduced by the minimum amount necessary so that they do not trigger the 20% excise tax imposed by Sections 280G and 4999 of the Internal Revenue Code. Based onupon the assumptions made, Mr. Corrato's severance payments and benefits wouldeach executive is below his respective Section 280G threshold. |

(Footnotes continued on the following page)

__________________________

need to be reduced in order to avoid the 20% excise tax, and the amount of his estimated reduction is shown in the table.

| (f) | The vested stock options held by Messrs. Corrato,Pollack, Migliorino, Rothkopf and Hanuscin had a value of approximately $171,501, $63,898$13,500, $0, $73,795 and $19,323,$34,362, respectively, based on the September 30, 20152016 closing price of $14.41$14.48 per share. Such value can be obtained in the event of termination due to voluntary termination, death, disability, retirement or cause only if the executive actually exercises the vested options in the manner provided for by the relevant option plan and subsequently sells the shares received for $14.41$14.48 per share. In the event of a termination of employment, each executive (or his or her estate in the event of death) will have the right to exercise vested stock options for the period specified in his or her option grant agreement. If the termination of employment occurs following a change in control, each executive can exercise the vested stock options for the remainder of the original ten-year term of the option. |

| (g) | Represents the value of the unvested stock options held by Messrs. Corrato,Pollack, Migliorino, Rothkopf and Hanuscin that had an exercise price below the September 30, 20152016 closing price of $14.41$14.48 per share, based on the difference between the September 30, 20152016 closing price and the per share exercise price of the unvested stock options. All unvested stock options will become fully vested upon an executive's death, disability or upon a change in control. |

| (h) | Represents the value of the unvested restricted stock awards held by Messrs. Corrato,Pollack, Migliorino, Rothkopf and Hanuscin based on the September 30, 20152016 closing price of $14.41$14.48 per share, excluding accumulated cash dividends, if any, on the unvested shares for each of the executives. All unvested restricted stock awards will become fully vested upon an executive's death or disability or upon a change in control. |

| (i) | Does not include the value of the vested benefits to be paid under our tax-qualified defined benefit pension plan, 401(k) plan and ESOP. See the pension benefits table under "-Benefit Plans – Retirement Plan" below. The ESOP provides that it will terminate upon a change in control,was terminated effective December 31, 2016, with the value of the unallocated ESOP shares held in the suspense account to first be used to repay the outstanding balance of the ESOP loan and with any remaining balance in the suspense account to then be allocated among the ESOP participants on a pro rata basis. The above tables do not include any additional ESOP allocations that wouldwill be made upon athe termination of the ESOP. Also does not include the value of vested stock options set forth in Note (f) above, earned but unpaid salary, accrued but unused vacation leave and reimbursable expenses. |

| (j) | If the employment of Mr. Corrato,Pollack, Mr. Migliorino, Mr. Rothkopf or Mr. Hanuscin had terminated at September 30, 20152016 due to death, his or her beneficiaries or estate would have received life insurance proceeds of approximately $551,264, $389,900$570,000, $400,000, $153,000 and $290,240,$120,120, respectively. If the employment of Mr. Corrato,Pollack, Mr. Migliorino, Mr. Rothkopf or Mr. Hanuscin had terminated at September 30, 20152016 due to disability, they each would have received disability benefits under our disability policy of $260,000, $260,000 and $241,000, respectively.$12,000 per year. |

Effective July

On May 1, 2015, Salvatore Fratanduono,2016, Mr. Corrato retired as the Senior Vice President and Chief LoanExecutive Officer of Prudential Bancorp and Prudential Bank as well as resigned from the Boards of Directors of Prudential Bancorp and Prudential Bank. In connection with such retirement, Mr. Corrato, entered into a consultingseparation agreement with Prudential Savings, which agreement superseded his employment agreement entered into previously.dated as of May 3, 2016, effective as of May 1, 2016. Under the terms of the consultingseparation agreement Mr. Fratanduono was to receive $7,500 per month for providing consulting services during a one year period ending June 30, 2016, subject to earlier termination. In addition,(which superseded his employment agreement), the Bank agreed to pay during the term of the consulting agreement Mr. Fratanduono's COBRA premiums for medical insurance. Mr. Fratanduono was entitled toCorrato $225,000, approximately his vested benefitscurrent annual base salary, in equal installments over a one-year period in accordance with the Bank's tax-qualified employee benefit plans consisting ofnormal payroll practices. Prudential Bank also agreed to transfer title to Mr. Corrato to the ESOP, the 401(k) plan and the Defined Benefit Plan but was no longer entitled to participate in any of the benefit plans or programs offeredautomobile which had been previously provided for his use by the Company or Prudential Savings. In addition, all unvested restricted stock awards and stock options granted to him were forfeited. In November 2015, the consulting agreement was terminated with no further payments due Mr. Fratanduono thereunder.

Mr. Vento retired as President as of July 1, 2015 and as Chief Executive Officer as of September 30, 2015 pursuant to a transition agreement entered into between the Bank and to pay his COBRA premiums (for medical, dental and vision insurance) for a period of up to six months subsequent to May 1, 2016. During the one-year period subsequent to May 1, 2016, Mr. VentoCorrato agreed to comply with certain restrictive covenants set forth in May 2015. In late December 2015,the separation agreement including covenants not to compete and to not solicit customers and employees of Prudential Bancorp and/or Prudential Bank. Mr. Vento resigned as Chairman of the Board of the boards of directors of the Company andCorrato also agreed to assist the Bank, and retiredif requested, with regard to certain ongoing lending relationships as a director from both boards of directors. As part of his retirement, his transition agreement was superseded by a retirement agreement underto which Mr. Vento was entitled to his vested benefits under the Bank's ESOP, 401(k) plan and the Defined Benefit Plan, the maintenance of a pre-existing split dollar agreement (the cost of which had previously been fully expensed) and the transfer of the Bank owned automobile used byCorrato has particular knowledge as well as with existing litigation. Mr. Vento. Mr. VentoCorrato is not entitled to participate in any of the employee benefit plans or programs offered by the CompanyPrudential Bancorp or thePrudential Bank subsequent to September 30, 2015May 1, 2016 and no additional benefits vested or accrued subsequent to such date. No acceleration of the unvested restricted stock awards and stock options previously granted to him occurred.occurred upon his retirement. Mr. VentoCorrato agreed to serve as a director emeritus until February 2020 without any cash compensation.

Benefit Plans

Retirement Plan. Prudential SavingsBank participates in the Financial Institutions Retirement Fund, a multiple employer defined benefit plan intended to satisfy the tax-qualification requirements of Section 401(a) of the Internal Revenue Code. Full-time employees become eligible to participate in the retirement plan upon the attainment of age 21 and the completion of one year of eligibility service. For purposes of the retirement plan, a full-time employee earns one year of eligibility service when he completes 1,000 hours of service within a one-year eligibility computation period. An employee's first eligibility computation period is the one-year period beginning on the employee's date of hire. Subsequent eligibility computation periods begin on January 1 and end on December 31. In November 2015, the retirement plan was frozen such that no new participants can be added and existing participants will receive no further benefit service credit, compensation credit or other accrued benefit increases except for additional service credits which may affect a participant's vesting or early vesting retirement eligibility or as otherwise required by law to maintain the tax-qualified status of such plan.

The retirement plan provides for a monthly benefit upon a participant's retirement at or after the age of 65, or if later, the fifth anniversary of the participant's initial participation in the retirement plan (i.e., the participant's "normal retirement date"). A participant may also receive a benefit on his early retirement date, which is the date on which he attains age 45 and is partially or fully vested under the terms of the retirement plan. Benefits received prior to a participant's normal retirement date are reduced by certain factors set forth in the retirement plan. The retirement plan provides a benefit of 1.50% of a participant's highest 5-year average earnings, multiplied by the participant's years of benefit service. Earnings are defined as base salary, subject to an annual Internal Revenue Service limit of $265,000 on earnings for 2015. Annual benefits provided under the retirement plan also are subject to Internal Revenue Service limits, which vary by age and benefit payment type. Participants become fully vested in their benefits under the retirement plan upon the completion of five years of vesting service as well as upon the attainment of normal retirement age (age 65).

The table below shows the present value of accumulated benefits payable to Messrs. Pollack, Corrato, Migliorino, Rothkopf Hanuscin, Fratanduono and Vento,Hanuscin, including the number of years of credited service, under the retirement plan determined using interest rate and mortality rate assumptions consistent with those used in our financial statements. No named executive officer received payments from the retirement plan during fiscal 2015.2016.

| Name | | Plan Name | | Number of Years Credited Service | | | Present Value of Accumulated Benefit(2) | | | Payments During Last Fiscal Year | | | Plan Name | | Number of Years Credited Service | | | Present Value of Accumulated Benefit(2) | | | Payments During Last Fiscal Year | |

| Joseph R. Corrato | | Financial Institutions Retirement Fund(1) | | | 30 | | | $ | 1,005,000 | | | $ | -- | | |

| | | | | | | | | | | | | | | | |

| Dennis Pollack | | | Financial Institutions Retirement Fund(1) | | | 0 | | | $ | -- | | | $ | -- | |

Joseph R. Corrato(3) | | | Financial Institutions Retirement Fund(1) | | | 30 | | | | 1,217,000 | | | | -- | |

| Jeffrey T. Hanuscin | | Financial Institutions Retirement Fund(1) | | | 1 | | | | 19,000 | | | | -- | | | Financial Institutions Retirement Fund(1) | | | 2 | | | | 28,000 | | | | -- | |

| | | | | | | | | | | | | | | | |

| Anthony V. Migliorino | | | Financial Institutions Retirement Fund(1) | | | 0 | | | | -- | | | | -- | |

| Jack E. Rothkopf | | Financial Institutions Retirement Fund(1) | | | 9 | | | | 147,000 | | | | -- | | | Financial Institutions Retirement Fund(1) | | | 9 | | | | 186,000 | | | | -- | |

| | | | | | | | | | | | | | | | |

Salvatore Fratanduono(3) | | Financial Institutions Retirement Fund(1) | | | 30 | | | | 600,000 | | | | -- | | |

| | | | | | | | | | | | | | | | |

Thomas A. Vento(4) | | Financial Institutions Retirement Fund(1) | | | 57 | | | �� | 1,941,000 | | | | -- | | |

_____________________

(1)A multiple employer tax-qualified defined benefit plan.

(2)Reflects value as of September 30, 2015.2016.

(3)Mr. FratanduonoCorrato resigned, effective JulyMay 1, 2015. 2016.

(4) Mr. Vento retired effective September 30, 2015. His benefit is limited by Internal Revenue Service limits on annual compensation included in earnings.

Endorsement Split Dollar Agreements. Prudential SavingsBank purchased insurance policies on the lives of its certain executive officers named in the Summary Compensation Table above, and has entered into Endorsement Split Dollar Agreements with eachcertain of those officers. The policies are owned by Prudential Savings.Bank. Under the agreements with the named executive officers, upon an officer's death while he or she remains employed by Prudential Savings,Bank, the officer's beneficiary will receive two times the officer's salary, other than Mr. Vento whose benefit totaled approximately $142,000 for fiscal 2015, as of the date of death. Pursuant to the terms of the agreements, Prudential SavingsBank has generally elected to not extend such benefits after a termination of employment. Such amounts will be funded from the receipt of the death benefits under the insurance policies on such officer's life in excess of the cash surrender value. Prudential SavingsBank will receive the full cash surrender value, which is expected to reimburse Prudential SavingsBank in full for its life insurance investment as well as the remainder, if any, in excess of the net proceeds after payments to the officer's beneficiaries.

The Endorsement Split Dollar Agreements may be terminated at any time by Prudential SavingsBank or the officer or by Prudential SavingsBank upon the officer's termination of service to Prudential Savings Bank. Upon termination, Prudential SavingsBank may surrender the policy and collect the cash surrender value.

Related Party Transactions

In accordance with applicable federal laws and regulations, Prudential SavingsBank offers mortgage loans to its directors, officers and employees as well as members of their immediate families for the financing of their primary residences and certain other loans. These loans are made on substantially the same terms as those prevailing at the time for comparable loans with persons not related to Prudential SavingsBank except that Prudential SavingsBank provides for a reduced interest rate of one hundred basis points to all employees, officers and directors for a first mortgage on their primary residence and waives the origination fees, other than appraisal and document review fees. Other than as described below, it is the belief of management that these loans neither involve more than the normal risk of collectability nor present other unfavorable features.

The table below lists the outstanding loans made by Prudential SavingsBank to related persons, where the amount involved exceeds $120,000 and the interest rate was reduced and loan origination fee was waived.

| | | | | Largest Principal | | | | | | Amounts Paid | | | | |

| | | | | Amount | | | Amount | | | During Year | | | | |

| | Year ended | | | Outstanding | | | Outstanding at | | | | | | | | | Interest | |

Name | | September 30, | | | During Year | | | Year-End | | | Principal | | | Interest | | | Rate | |

Joseph R. Corrato | | | 2015

2014

| | | $ | | | | | | | | | | | | | | | | | | | | | | Largest Principal | | | | | | | | | | | | | | | | | | | | Amount | | | Amount | | | | | | | | | | | | | | Year ended | | | Outstanding | | | Outstanding at | | | | | | | | | Interest | | | Name | | September 30, | | | During Year | | | Year-End | | | Principal | | | Interest | | | Rate | | | Joseph R. Corrato | | | 2016 2015 | | | $ | 212,790 224,288 | | | $ | 200,645 212,790 | | | $ | 12,145 11,498 | | | $ | 5,694 6,024 | | | | 2.750 | % 2.750 | | John C. Hosier | | | 2016 2015 | | | | 378,527 387,620 | | | | 369,147 378,527 | | | | 9,380 9,692 | | | | 11,695 4,984 | | | | 3.125 3.125 | | | Jack E. Rothkopf | | | 2016 2015 | | | | 169,140 174,081 | | | | 164,040 169,140 | | | | 5,100 4,941 | | | | 5,210 5,370 | | | | 3.125 3.125 | |

| 224,288

235,446

| | | $

| 212,790

224,288

| | | $

| 11,498

11,157

| | | $

| 6,024

6,339

| | | | 2,750

2,750

| %

|

| | | | | | | | | | | | | | | | | | | | | | | | |

John C. Hosier | | | 2015

2014

| | | | 387,620

396,433

| | | | 378,527

387,620

| | | | 9,692

8,813

| | | | 4,984

12,263

| | | | 3.125

3.125

| |

| | | | | | | | | | | | | | | | | | | | | | | | |

Jack E. Rothkopf | | | 2015

2014

| | | | 174,081

178,870

| | | | 169,140

174,081

| | | | 4,941

4,789

| | | | 5,370

5,521

| | | | 3.125

3.125

| |

Two commercial mortgage loans and two lines of credit aggregating approximately $562,195 and $560,375, at September 30, 2015 and 2014, respectively, were extended to a company in which Mr. Vento's daughter was a principal. In addition, Prudential Savings Bank also extended a single-family residential mortgage loan which had a principal balance of approximately $150,573 and $154,002 at September 30, 2015 and 2014, respectively. All of the loans were restructured during fiscal 2013 and were current at September 30, 2015. However, due to the payment history of the loan relationship, all five loans were classified as substandard and place on non-accrual as of September 30, 2013 and 2014. The loans had been returned to accrual status as of September 30, 2015 due to the sufficiently long period of performance in accordance with their restructured terms. During fiscal 2015 and 2014, the highest aggregate principal balance of the five loans was approximately $730,009 and $746,675, respectively, principal paid was approximately $17,241 and $16,665, respectively, and interest paid was $33,792 and $34,272, respectively. The two commercial mortgage loans bear interest at 5.125% (for both 2015 and 2014), the residential loan bears interest at 3.0% (for both 2015 and 2014), and both lines of credit bear interest at 5.25%. All five loans were made on substantially the same terms, including interest rate and collateral as loans with persons not related to Prudential Savings. The Bank currently does not anticipate incurring any loss of principal or interest on the five loans.

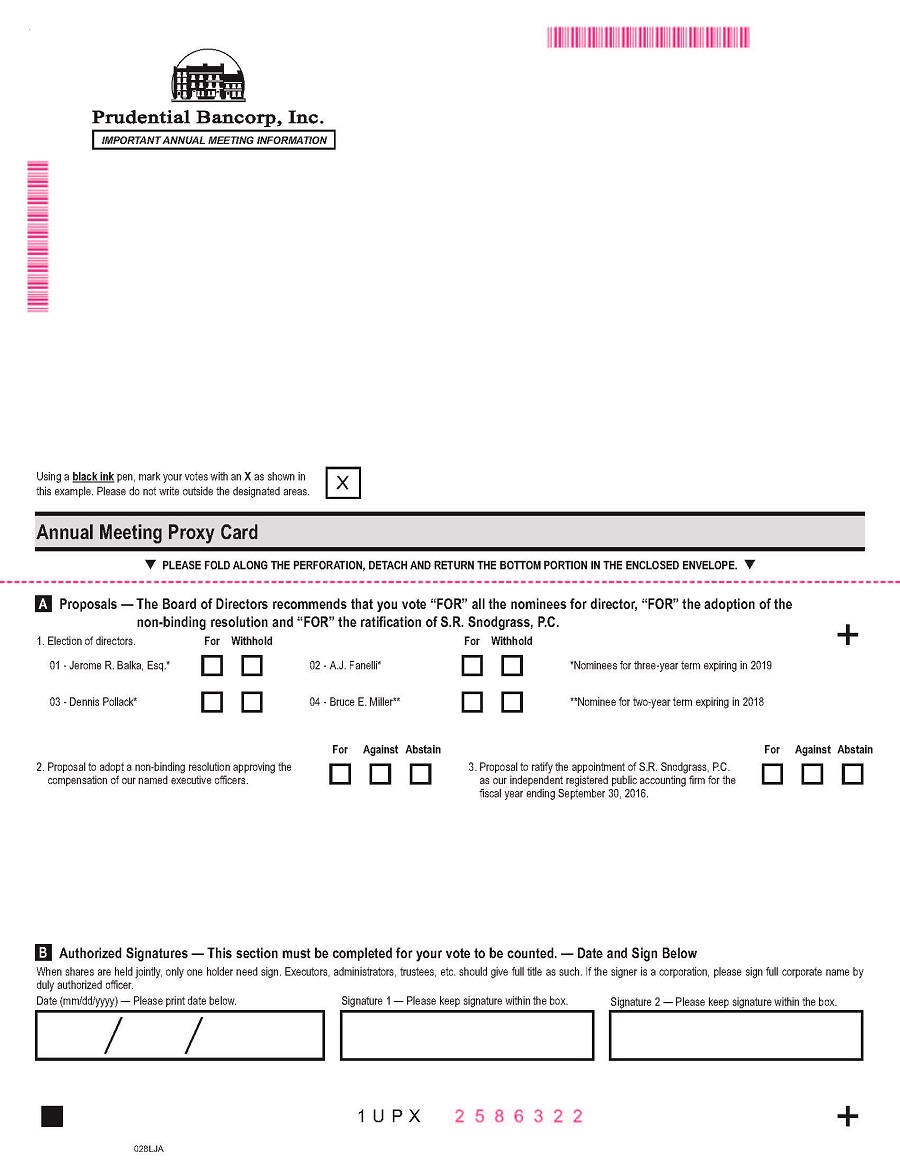

PROPOSAL TO ADOPT A NON-BINDING RESOLUTION TO APPROVE

THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

(PROPOSAL TWO)

|

Pursuant to Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act"), the proxy rules of the Securities and Exchange Commission were amended to require that not less frequently than once every three years, a proxy statement for an annual meeting of shareholders for which the proxy solicitation rules of the Securities and Exchange Commission require compensation disclosure must also include a separate resolution subject to shareholder vote to approve the compensation of the Company's named executive officers disclosed in the proxy statement.

This proposal, commonly known as a "say on pay" proposal, requests shareholders to support the compensation of the named executive officers as disclosed in this proxy statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of such officers as described on this proxy statement.

The executive officers named in the summary compensation table and deemed to be "named executive officers" are Joseph R. Corrato, Jack E. Rothkopf and Jeffrey T. Hanuscin as well as Thomas A. Vento, the former President and Chief Executive Officer, and Salvatore Fratanduono, a former executive officer of Prudential Savings. The proposal gives shareholders the ability to vote on the compensation of our named executive officers as disclosed in this proxy statement through the following resolution:

"Resolved, that the compensation paid to the Company's named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby approved."

The shareholder vote on this proposal is not binding on the Company or the board of directors and cannot be construed as overruling any decision made by the board of directors. However, the board of directors of the Company will review the voting results on the non-binding resolution and take them into consideration when making future decisions regarding executive compensation.

The Board of Directors recommends that you vote "FOR" the non-binding resolution to approve the compensation of our named executive officers.

BENEFICIAL OWNERSHIP OF COMMON STOCK BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

The following table sets forth as of December 18, 2015, the voting record date, certain information as to thePrudential Bancorp common stock beneficially owned, as of January 9, 2017, by (i) each personthe only persons or entity,entities, including any "group" as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), who or which was known to usPrudential Bancorp to be the beneficial owner of more than 5% of the issued and outstanding Prudential Bancorp common stock, based on filings made with the Securities and Exchange Commission, (ii) the directorseach director of Prudential Bancorp, (iii) certain executive officers of Prudential Bancorp (including Prudential Savings Bank); and (iv) all directors and executive officers of Prudential Bancorp as a group. Does not reflect ownership of shares of Prudential Bancorp common stock received by persons or entities in connection with the merger of Polonia Bancorp, Inc. ("Polonia Bancorp") with and into Prudential Bancorp which occurred just prior to the voting record date for the annual meeting.

Name of Beneficial Owner or Number of Persons in Group | | Amount and Nature of Beneficial Ownership as of December 18, 2015(1) | | | Percent of Common Stock(2) | |

Prudential Savings Bank Employee Stock Ownership Plan 1834 West Oregon Avenue Philadelphia, Pennsylvania 19145 | | | 697,270 | (3) | | | 8.3 | % |

EJF Capital LLC 2107 Wilson Boulevard, Suite 410 Arlington, Virginia 22201 | | | 500,000 | (4) | | | 6.0 | % |

Firefly Value Partners, LP 601 West 26th Street Suite 1520 New York, New York 10001 | | | 475,250 | (5) | | | 5.7 | % |

Warren A. Mackey 40 Worth Street, 10th Floor New York, New York 10013 | | | 871,204 | (6) | | | 10.4 | % |

Maltese Capital Management LLC 150 East 52nd Street 30th Floor New York, New York 10022 | | | 484,900 | (7) | | | 5.8 | % |

Lawrence B. Seidman 100 Misty Lane, 1st Floor Parsippany, New Jersey 07054 | | | 702,598 | (8) | | | 8.4 | % |

Directors: | | | | | | | | |

Jerome R. Balka, Esq. | | | 58,933 | (9)(10) | | | * | |

Joseph R. Corrato | | | 130,219 | (9)(11) | | | 1.5 | % |

A. J. Fanelli | | | 51,171 | (9)(12) | | | * | |

John C. Hosier | | | 48,211 | (9)(13) | | | * | |

Bruce E. Miller | | | 36,750 | (9) | | | * | |

Francis V. Mulcahy | | | 55,031 | (9)(14) | | | * | |

Dennis Pollack | | | 29,798 | (9)(15) | | | * | |

| Other Named Executive Officers (16): | | | | | | | | |

Jack E. Rothkopf | | | 13,329 | (9)(17) | | | * | |

Jeffrey T. Hanuscin | | | 50,934 | (9)(18) | | | * | |

| All Directors and Executive Officers as a group (11 persons) | | | 475,467 | (7) | | | 5.5 | % |

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership as of January 9, 2017(1)(2) | | | Percent of Common Stock | |

| | | | | | | |

Firefly Value Partners, LP 601 West 26th Street Suite 1520 New York, New York 10001 | | | 475,250 | (3) | | | 5.3 | % |

Warren A. Mackey 40 Worth Street, 10th Floor New York, New York 10013 | | | 871,204 | (4) | | | 9.7 | % |

Lawrence B. Seidman 100 Misty Lane, 1st Floor Parsippany, New Jersey 07054 | | | 750,318 | (5) | | | 8.3 | % |

Directors: | | | | | | | | |

Jerome R. Balka, Esq. | | | 70,933 | (6)(7) | | | * | |

A. J. Fanelli | | | 63,171 | (6)(8) | | | * | |

John C. Hosier | | | 62,939 | (6)(9) | | | * | |

Bruce E. Miller | | | 56,088 | (6) | | | * | |

Francis V. Mulcahy | | | 67,031 | (6)(10) | | | * | |

Dennis Pollack | | | 46,936 | (6)(11) | | | * | |

| Certain Executive Officers | | | | | | | | |

Anthony V. Migliorino | | | 11,022 | (6)(12) | | | * | |

Jack E. Rothkopf | | | 72,358 | (6)(13) | | | * | |

Jeffrey T. Hanuscin | | | 20,995 | (6)(14) | | | * | |

| All Directors and Executive Officers as a Group (10 persons) | | | 471,473 | (7) | | | 5.1 | % |

___________________

*Represents less than one percent of Prudential Bancorp's outstanding common stock.

| (1) | Based upon filings made pursuant to the Securities Exchange Act of 1934 and information furnished by the respective individuals. In addition, due to share repurchases by the Company, the ownership percentages reflected in the filings may differ from the percentages reflected in the table above. Furthermore, share ownership reflected on Schedules 13D and 13G may differ from what is actually held by the reporting persons as of the voting record dateJanuary 9, 2017 due to changes in ownership which were not required to be reported prior to such date. In addition, does not reflect shares that may have been received in the voting record date.merger with Polonia Bancorp by (i) shareholders of the Company who owned in excess of 5% of the Company's common stock who were also shareholders of Polonia Bancorp or who received a number of shares of common stock such that they would be beneficial owners of more than 5% of the Company's common stock, or (ii) who were shareholders of Polonia Bancorp who received sufficient shares to become beneficial owners of more than 5% of the Company's common stock. Under regulations promulgated pursuant to the Securities Exchange Act of 1934, shares of common stock are deemed to be beneficially owned by a person if he or she directly or indirectly has or shares (i) voting power, which includes the power to vote or to direct the voting of the shares, or (ii) investment power, which includes the power to dispose or to direct the disposition of the shares. Unless otherwise indicated, the named beneficial owner has sole voting and dispositive power with respect to the shares. |

(Footnotes continued on following pages)

page)

______________________________________

| (2) | Each beneficial owner's percentage ownership is determined by assuming that options held by such person (but not those held by any other person) and that are exercisable within 60 days of the voting record dateNovember 10, 2016 have been exercised. |

| (3) | As of December 18, 2015, 213,601 shares held in the Prudential Savings Bank Employee Stock Ownership Plan trust had been allocated to the accounts of participating employees. Shares beneficially owned by the plan trustees, Messrs. Fanelli, Hosier and Mulcahy, do not include shares held in the trust. Under the terms of the plan, the trustees vote all allocated shares in accordance with the instructions of the participating employees. Any unallocated shares are generally required to be voted by the plan trustees in the same ratio on any matter as to those shares for which instructions are given by the participants. |

(4) | Based on a Schedule 13G/A filed with the Securities and Exchange Commission on February 13, 2015 by EJF Capital LLC ("EJF"), Emanuel J. Friedman, EJF Financial Services Fund, L.P. ("EJF Fund"), and EJF Financial Services GP ("EJF Fund GP"), LLC. EJF has shared voting and dispositive power with respect to all the shares. EJF Fund is the record owner of the shares. EJF Fund GP serves as the general partner and investment manager of EJF Fund and may be deemed to share beneficial ownership of the shares of common stock of which EJF Fund is the record owner. EJF is the sole member and manager of EJF Fund GP and may be deemed to share beneficial ownership of the shares of common stock of which such entity may share beneficial ownership. Emanuel J. Friedman is the controlling member of EJF and may be deemed to share beneficial ownership of the shares of common stock over which EJF may share beneficial ownership. |

(5) | Based on a Schedule 13G/A filed with the Securities and Exchange Commission on February 17, 201516, 2016 by Firefly Value Partners, LP ("Firefly Partners"), FBPFVP GP, LLC ("FVPGP"), Firefly Management Company GP, LLC ("Firefly Management"), FVP Master Fund, L.P. ("FVP MasterFund"), Ryan Heslop and Ariel Warszawski. Firefly Partners is the investment manager of FVP Master Fund; FVP GP serves as the general partner of FVP Master Fund; and Firefly Management serves as general partner of Firefly Partners. Messrs. Heslop and Warszawski are the managing members of FVP GP and Firefly Management. FVP Master Fund directly owns the shares set forth in the Schedule 13G/A. Messrs. Heslop and Warszawski, Firefly Partners, Firefly Management and FVP GP may be deemed to share with FVP Master Fund both voting and dispositive power with respect to such shares. |

(6)(4) | Based on a Schedule 13D/A filed with the Securities and Exchange Commission on February 12, 2014 by Warren A. Mackey, Homestead Partners LP, a Delaware limited partnership, Arles Partners LP, a New York limited partnership, and Arles Advisors Inc., a New York corporation. Arles Advisors is the general partner of Homestead Partners and Arles Partners. The sole shareholder, director and executive officer of Arles Advisors is Warren A. Mackey. By virtue of his position with Arles Advisors, Mr. Mackey has the shared investment discretion and voting authority with respect to the 838,676 shares owned by Homestead Partners and Arles Partners. Arles Advisors, as general partner of Homestead Partners and Arles Partners, may be deemed to beneficially own the 838,976 shares owned by these partnerships. Mr. Mackey individually has the sole investment discretion and voting authority with respect to the 32,228 shares held for himself. Additional shares of Prudential Bancorp common stock may have been received in connection with the merger with Polonia Bancorp. |

(7) | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 12, 2015 by Maltese Capital Management LLC ("Maltese Capital') and Terry Maltese, the managing member of Maltese Capital. Maltese Capital and Mr. Maltese may be deemed to share both voting and dispositive power with respect to the shares reported in the Schedule 13G. |

(8)(5) | Based on a Schedule 13D/A filed on August 17, 2015December 6, 2016 by Lawrence B. Seidman, Seidman and Associates L.L.C. ("SAL"), Seidman Investment Partnership, L.P. ("SIP"), Seidman Investment Partnership II, L.P. ("SIPII"), Seidman Investment Partnership III, L.P. ("SIPIII"), LSBK06-08 ("LSBK"), Broad Park Investors ("Broad Park"), CBPS, L.L.C. ("CBPS"), JRBC I, LLC ("JRBC"), 2514 Multi-Strategy Fund, L.P. ("2514 MSF"), Veteri Place Corporation ("Veteri"), Chewy Gooey Cookies, L.P. ("CGC"), and Sonia Seidman and Dennis Pollack (collectively, the "Seidman Group") as well as a Form 4 filed by Mr. Pollack on June 3, 2015.. Mr. Seidman (i) as the manager of SAL, may be deemed the beneficial owner of the 139,347 shares owned by SAL, (ii) as the sole officer of Veteri, the corporate general partner of each of SIP and SIPII, may be deemed the beneficial owner of the 93,972110,606 shares owned by SIP and the 130,619157,905 shares owned by SIPII, (iii) as the managing member of JBRC I, LLC, the co-general partner of SIPIII, may be deemed the beneficial owner of the 18,00027,780 shares owned by SIPIII, (iv) as the sole officer of Veteri, the Trading Advisor of LSBK and CBPS, may be deemed the beneficial owner of the 59,42675,393 shares owned by LSBK and the 70,00083,181 shares owned by CBPS, (v) as the investment manager for each of Broad Park and 2514 MSF,CGC, may be deemed the beneficial owner of the 87,80090,968 shares owned by Broad Park and the 27,00022,147 shares owned by 2514 MSF,CGC, and (vi) as the husband of Sonia Seidman, may be deemed the beneficial owner of the 46,63643,261 shares owned by Sonia Seidman. Accordingly, Seidman may be deemed the beneficial owner of an aggregate of 672,800750,318 shares. In the foregoing capacities, Seidman has sole and exclusive investment discretion and voting authority with respect to all such shares. Mr. Pollack individually hasAdditional shares of Prudential Bancorp may have been received in connection with the sole investment discretion and voting authoritymerger with regard to the 29,798 shares owned thereby included in the amount shown in the table.Polonia Bancorp. |

(Footnotes continued on following page)

_______________________

(9)(6) | Includes shares held in trust by Prudential Bancorp'sPrudential's 2008 RRP or granted pursuant to the 2014 SIP which have been awarded to the directors and officers and stock options which have been granted to the directors and officers under Prudential Bancorp'sPrudential's 2008 SOP or under the 2014 SIP and which are exercisable within 60 days of the voting record dateJanuary 9, 2016 as follows: |

| Name | | Restricted Stock | | | Stock Options | | | Restricted Stock | | | Stock Options | |

| Jerome R. Balka, Esq. | | | 10,000 | | | | 22,690 | | | | 8,000 | | | | 34,690 | |

| Joseph R. Corrato | | | 32,266 | | | | 61,029 | | |

| A.J. Fanelli | | | 10,000 | | | | 26,690 | | | | 8,000 | | | | 38,690 | |

| John C. Hosier | | | 13,203 | | | | 21,352 | | | | 9,068 | | | | 36,021 | |

| Bruce E. Miller | | | 13,204 | | | | 13,345 | | | | 9,070 | | | | 30,683 | |

| Francis V. Mulcahy | | | 10,000 | | | | 26,690 | | | | 8,000 | | | | 38,690 | |

| Dennis Pollack | | | 10,000 | | | | -- | | | | 10,500 | | | | 12,000 | |

| Anthony V. Migliorino | | | | 7,500 | | | | -- | |

| Jack E. Rothkopf | | | 16,247 | | | | 22,223 | | | | 12,416 | | | | 43,403 | |

| Jeffrey T. Hanuscin | | | 7,210 | | | | 4,068 | | | | 5,474 | | | | 10,502 | |

| All directors and executive officers as a group (11 persons) | | | 122,130 | | | | 202,087 | | |

| All directors and executive officers as a group (9 persons) | | | | 78,028 | | | | 244,679 | |

| | | | | | | | | | |

(Footnotes continued on following page)

____________________

(10)(7) | Includes 4,721 shares held in Mr. Balka's individual retirement account, 14,375 shares held jointly with Mr. Balka's spouse, 1,888 shares held in Mr. Balka's 401(k) Plan and 66 shares held by the estate of Helen Klara for whom Mr. Balka is guardian. Also includes 4,721 shares held by the Balka Grandchildren Trust and 472 shares held by the Danielle Thomas Revocable Trust, over which Mr. Balka disclaims beneficial ownership. |

(11) | Includes 7,037 shares and 13,399 shares allocated to Mr. Corrato's accounts in Prudential Savings' 401(k) Plan and ESOP, respectively, over which Mr. Corrato has voting power and 82 shares held by Mr. Corrato as custodian for his son. |

(12)(8) | Includes 3,304 shares held jointly with Mr. Fanelli's spouse. |

(13)(9) | Includes 6,0186,078 shares held in Mr. Hosier's account in his 401(k) plan. |

(14)(10) | Includes 2,0004,000 shares held jointly with Mr. Mulcahy's spouse and 2,832 shares held directly by Mr. Mulcahy's spouse. |

(15)(11) | Includes 19,588 shares held in Mr. Pollack's individual retirement account. Mr. Pollack disclaims beneficial ownership of the 672,800 shares owned by the Seidman Group excluding his shares. |

(16)(12) | Excludes Messrs. VentoIncludes 1,522 shares allocated to Mr. Migliorino in the Prudential Bank 401(k) Plan and Fratanduono who are no longer officers and/or directors of Prudential Bancorp.1,000 shares held in Mr. Migliorino's individual retirement account. |

(17)(13) | Includes 6377,908 shares (unitsallocated to Mr. Rothkopf's account in the Prudential Bank employee stock ownership plan, referred to as the ESOP over which Mr. Rothkopf has voting authority. |

| (14) | Includes 908 and 9442,042 shares allocated to Mr. Hanuscin in Prudential SavingsBank 401(k) Plan and the ESOP, respectively, over which Mr. Hanuscin has voting power. |

(18) | Includes 6,337 shares allocated to Mr. Rothkopf's account in the ESOP over which Mr. Rothkopf has voting authority. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the officers and directors, and persons who own more than 10% of Prudential Bancorp's common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and greater than 10% shareholders are required by regulation to furnish Prudential Bancorp with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of such forms furnished to us, or written representations from our officers and directors, we believe that during, and with respect to, the fiscal year ended September 30, 2015,2016, our officers and directors complied in all respects with the reporting requirements promulgated under Section 16(a) of the Securities Exchange Act of 1934.

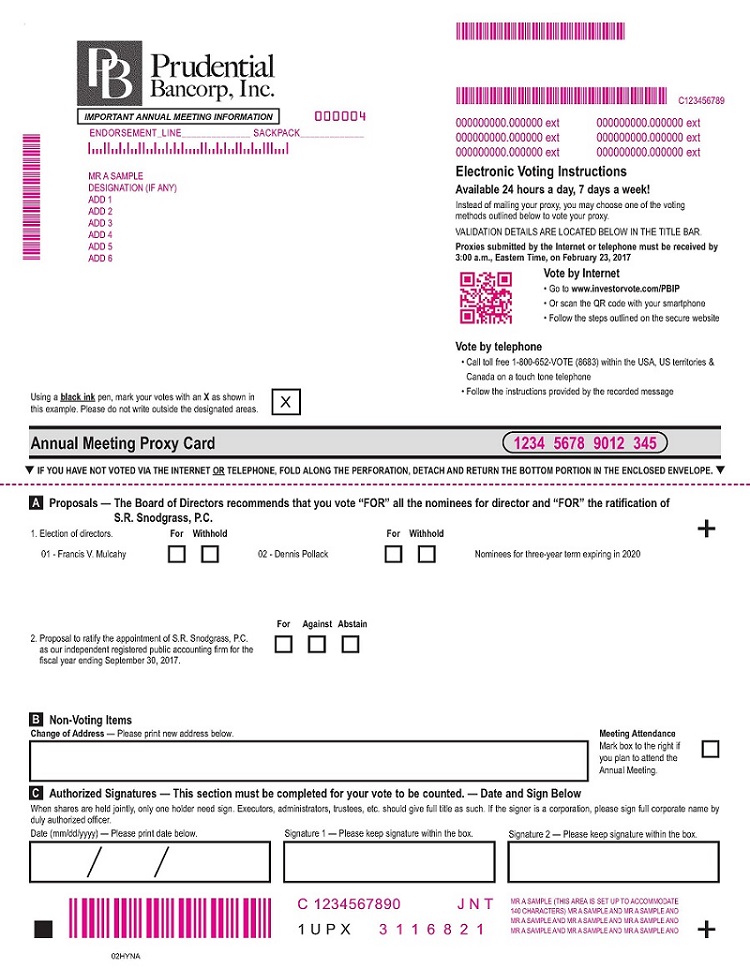

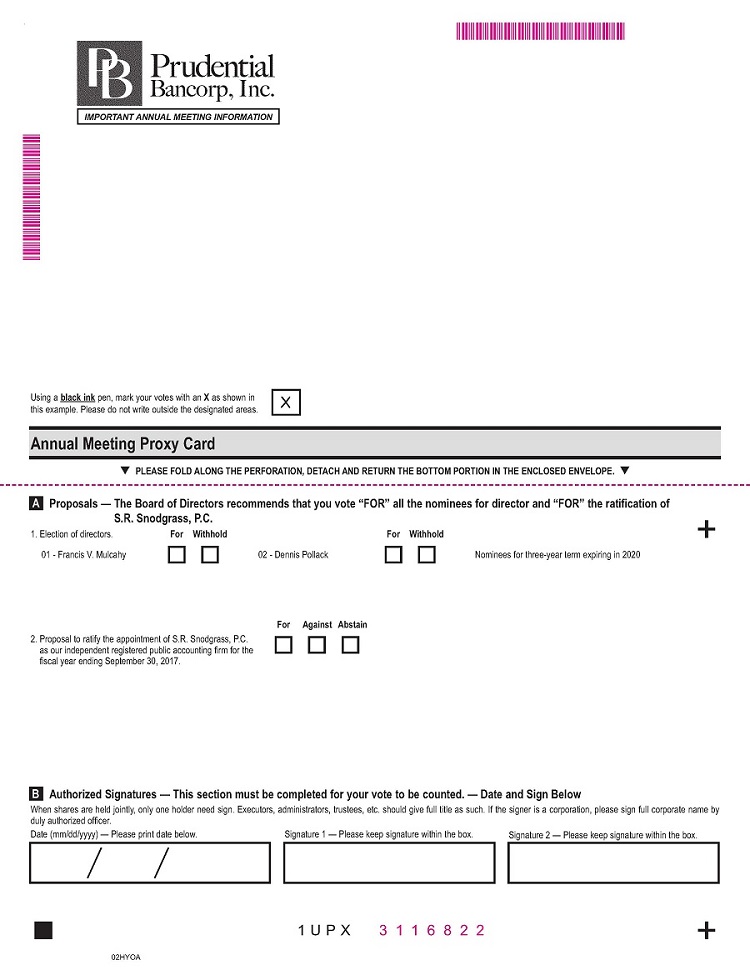

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL THREE)TWO) |

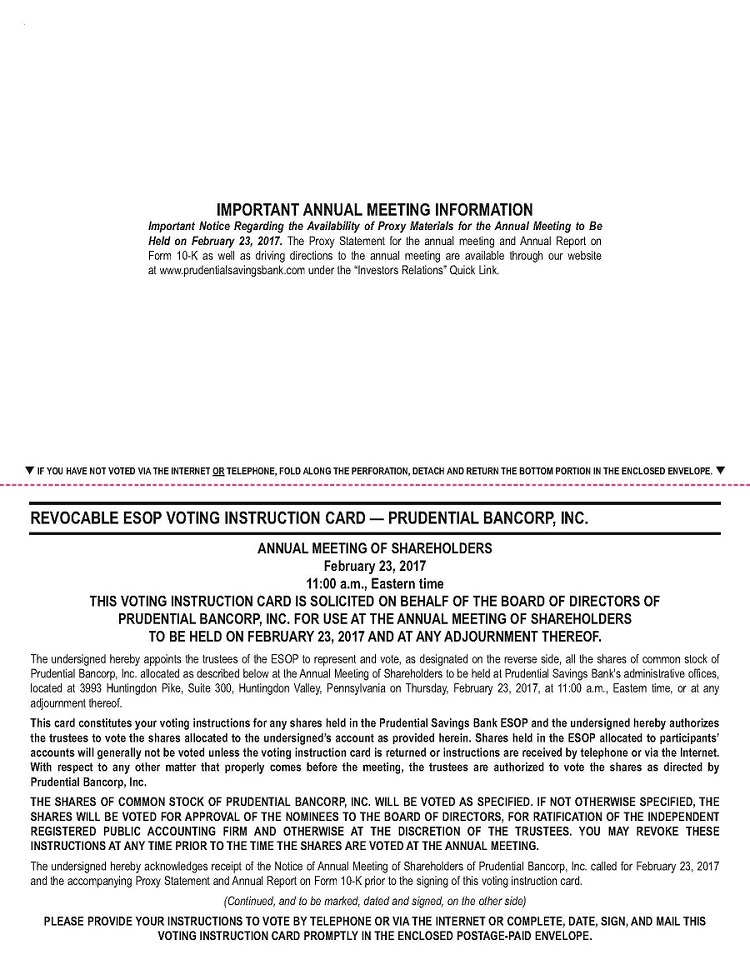

The Audit Committee of the Board of Directors of Prudential Bancorp has appointed S.R. Snodgrass, P.C., an independent registered public accounting firm, to perform the audit of our financial statements for the year ending September 30, 2016,2017, and further directed that the appointment of S.R. Snodgrass as our auditors be submitted for ratification by the shareholders at the annual meeting.

We have been advised by S.R. Snodgrass that neither that firm nor any of its associates has any relationship with Prudential Bancorp or its subsidiaries other than the usual relationship that exists between an independent registered public accounting firm and its clients. S.R. Snodgrass will have one or more representatives at the annual meeting who will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

In determining whether to appoint S.R. Snodgrass as our independent registered public accounting firm, the Audit Committee considered whether the provision of services, other than auditing services, by S.R. Snodgrass is compatible with maintaining its independence. In addition to performing auditing services, our independent registered public accounting firm reviewed our public filings. The Audit Committee believes that S.R. Snodgrass's performance of these other services is compatible with maintaining the independent registered public accounting firm's independence.

Audit Fees

The following table sets forth the aggregate fees paid by us to S.R. Snodgrass for professional services in connection with the audit of Prudential Bancorp's consolidated financial statements for fiscal 20152016 and 20142015 and the fees paid by us to S.R. Snodgrass for audit-related services, tax services and all other services during fiscal 20152016 and 2014.2015.

| | Year Ended September 30, | |

| | | 2015 | | | 2014 | |

Audit fees (1) | | $ | 169,858 | | | $ | 161,257 | |

Audit-related fees | | | -- | | | | -- | |

Tax fees (2) | | | 22,770 | | | | 24,564 | |

All other fees | | | -- | | | | -- | |

Total | | $ | 192,628 | | | $ | 185,821 | |

| | Year Ended September 30, | |

| | | 2016 | | | 2015 | |

| Audit fees (1) | | $ | 178,000 | | | $ | 169,858 | |

| Audit-related fees | | | -- | | | | -- | |

| Tax fees (2) | | | 20,300 | | | | 22,770 | |

| All other fees (3) | | | 9,000 | | | | -- | |

| Total | | $ | 207,300 | | | $ | 192,628 | |